Finance is one of the biggest skills each and everyone should learn in their life. By reading personal finance, books help you in managing your finances better. By reading books, you will get answers to every question that arises in your mind. In addition, such books help you gain more insights like how to pay off debts, be smarter with the money, and give you the confidence to handle your money.

Financial learning will help you in areas like investments, savings, expenses, and much more. It will help you in meeting long-term as well as short- terms goals. Even if your financial situation is not well balanced right now, the books below guide you the best and help you manage your wealth stable.

The Total Money Makeover is a self-help book with many real-life examples of people who followed Dave’s baby steps and experienced results. The book is one of the best finance books that contain a lot of motivating aid, suggestions and guidance. One of the most significant barriers to taking complete control of one’s money is a lack of desire and support to make the required lifestyle adjustments. This book helps you by providing a fresh outlook of your goals and the rewards you can acquire by achieving those goals.

The Richest Man in Babylon

Countless readers have been helped by the famous “Babylonian parables,” hailed as the greatest of all inspirational works on the subject of thrift, financial planning, and personal wealth.

The Total Money Makeover (Author: Dave Ramsey)

The Total Money Makeover is a self-help book with many real-life examples of people who followed Dave’s baby steps and experienced results. The book is one of the best finance books that contain a lot of motivating aid, suggestions and guidance. One of the most significant barriers to taking complete control of one’s money is a lack of desire and support to make the required lifestyle adjustments. This book helps you by providing a fresh outlook of your goals and the rewards you can acquire by achieving those goals.

The Millionaire Next Door

This book throws light on the investing style of intelligent investors. It talks about how millionaires are thoughtful about generating wealth and live frugally in their daily lives. The author analyses the habits of many American millionaires who grew their money without even making it to the headlines.

The Only Investment Guide You’ll Ever Need

The Only Investment Guide You’ll Ever Need is a book written by Andrew Tobias published in 1978 that concerns common sense rules that the ordinary saver can live by. In short, the book advises the following: 1. No reliable methods exist of speedily accumulating vast riches.

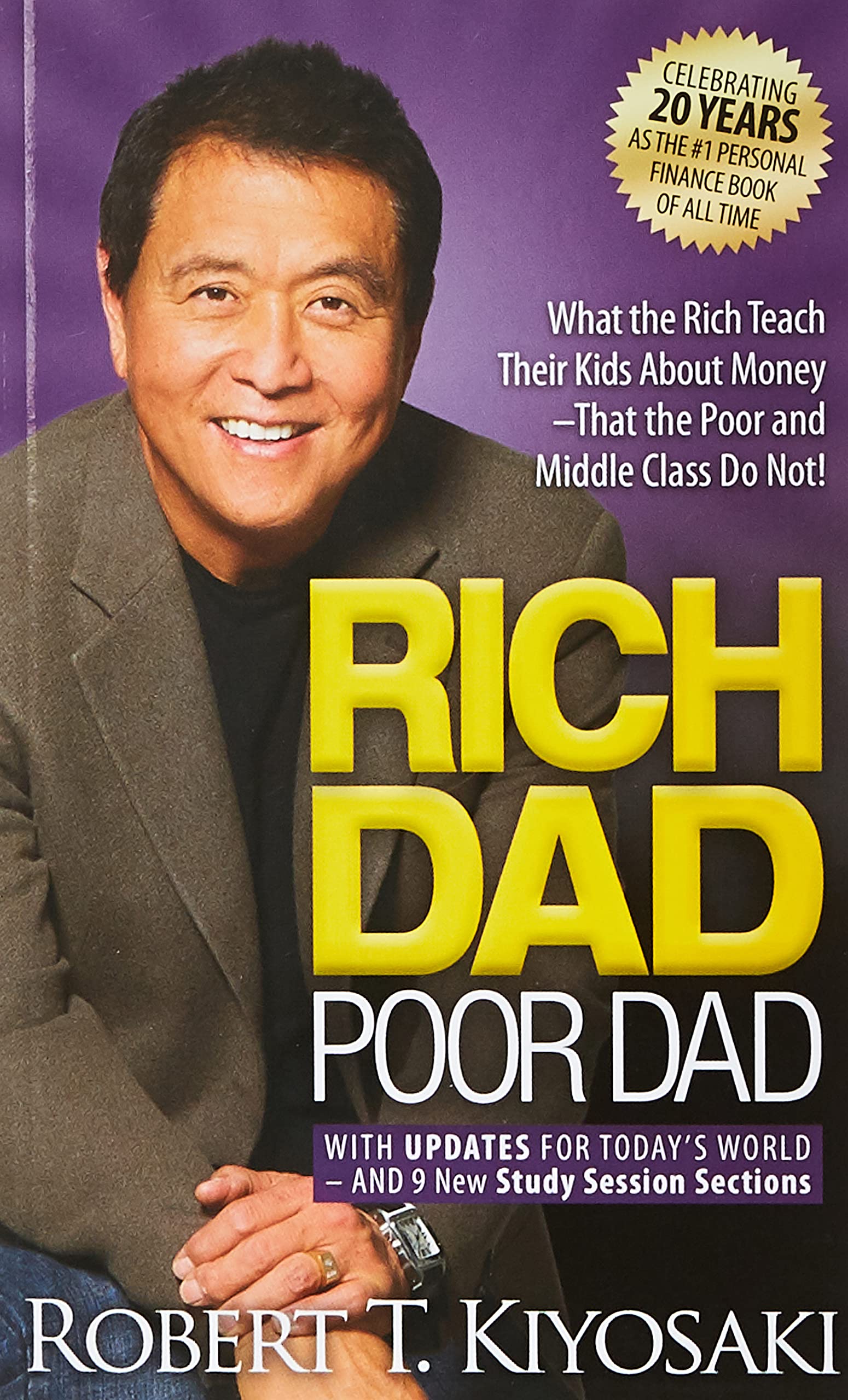

Rich dad poor dad

You’ve probably heard of Robert Kiyosaki’s “Rich Dad Poor Dad,” but there’s a reason it’s stuck around for more than two decades. In one of the most popular personal finance books of all time, Kiyosaki shares what he learned growing up from his father and his friend’s father, the latter of which is the “rich dad” in the title. Those lessons include how you don’t need to make a lot of money to get rich

You Need a Budget

The technique outlined in this book helps one to live a little more freely and alleviates the anxieties that come with a lack of funds. The author’s tried-and-tested technique of four basic rules seeks to turn money management from a crippling burden to a strong weapon that puts one in complete charge of one’s life. The book explains how to get out of debt and break free from a life of living paycheck to paycheck.